Please note that I am definitely NOT a legal expert in this area; I’m a professional accountant but I present this information so as to put the Corporate Minute Book on your radar and to facilitate a conversation with your lawyer.

As a small business owner, YOU should also be aware of what you ask your accountant or bookkeeper to do with regards the Minute Book and what you should defer to your lawyer.

What is a Corporate Minute Book?

A corporate minute book is a binder a Canadian Controlled Private Corporation (CCPC) must legally maintain. It should be created when the corporation starts and contain documents about the creation of the company as well as records about the history of running the corporation.

You may choose to hire a lawyer to keep this binder at their premises and update/maintain it on a regular basis for a fee of course.

What Should a Corporate Minute Book Contain?

In a typical Minute Book, you should be able to see the paperwork for:

- the annual renewal of your company with your provincial and/or federal government;

- minutes pertaining to your annual general meeting;

- resolutions or decisions made by the board of directors, officers, or shareholders like dividends declared; and of course

- your incorporation papers and share certificates.

You should see these sections / tabs in your Minute Book:

- Certificate of Incorporation By-laws

- Shareholders Meetings including resolutions

- Notices including completed income tax and GST/HST returns and notice of assessments

- Financial Statements

- Disclosure Register

- Unanimous Shareholder Agreements

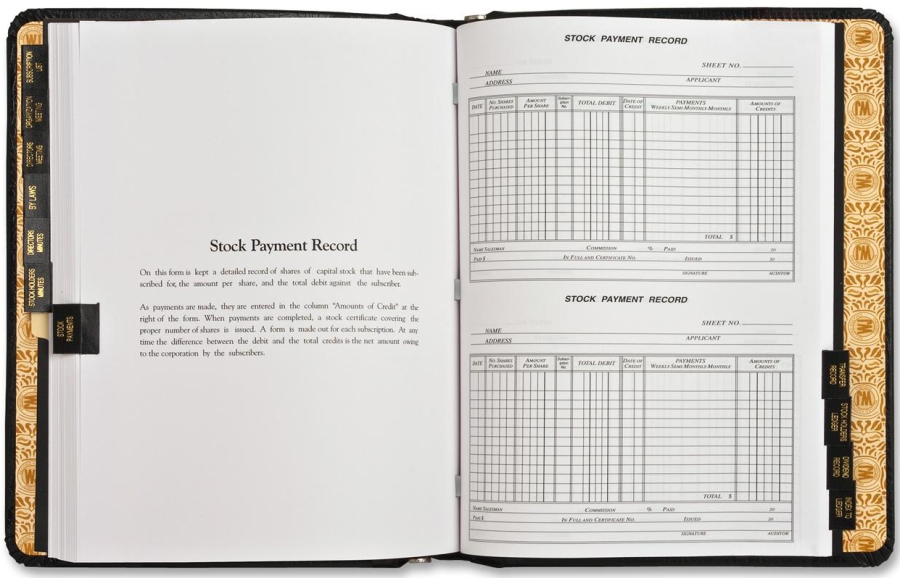

- Securities Register for Shareholders Ledgers and Transfers

- Security Certificates

- Annual Returns – Proof of Filing

- Contracts

- Other sensitive corporate Information

Note: it is not uncommon for you as a small business owner to keep any completed income tax and GST/HST returns, notice of assessments and financial statements elsewhere in your permanent files and not in the actual Corporte Minute Book binder.

Do YOU Really Need a Corporate Minute Book?

Canadian law governs corporate statutes. This is where you find the obligation for a corporation to maintain a corporate minute book. In certain circumstances, statutory penalties may be assessed for “failure to attend to the Minute Book”.

On some occasion, third parties such as CRA, accountants, bankers or even other federal or provincial authorities may need to examine your minute book. It should be made available to them when requested.

Do YOU Need a Lawyer to Maintain YOUR Minute Book?

You may need to seek legal assistance in recording some of the non-routine resolutions or decisions in your minute book. Routine documentation may or may not require legal assistance.

An example of a routine document is the resolution to accept the publication of financial statements and the appointment of the auditor. Another example is to have shareholder resolutions determine the number of directors, appointing the directors, naming the signatories, adopting the financial statements, other resolutions put forth including stating the annual reference date for the annual report filing.

Keeping in mind that the accountant ‘s role with respect to the Minute Book is one of quality control. YOU should NOT ask your accountant to:

- “represent the contents of a minute book for the basis of legal opinion”; or

- update its content without legal representation.

However, you can take on these tasks yourself but it is advisable to seek the services of a lawyer. We can suggest quite a few good ones to you.

What About the Annual Report Requirements?

The Annual Report does not refer to the publication released by public companies for third party use and analysis. The Annual Report referred to here is a report that you are required to file with your provincial and/or federal government.

There may be consequences if you fail to file your Annual Reports, including having your corporation struck from the registry.

What Are The Benefits of a Minute Book?

One of the benefits of having an up-to-date Minute Book comes when a business owner decides to sell the business. It makes the selling process easier and less expensive.

What Are The Consequences of Not Maintaining a Corporate Minute Book?

These includes:

- loss of ability to borrow funds

- loss of ability to sell the corporate shares and qualify for small business capital gains deduction

- being struck from the registry

- being unable to make shareholder dividend payments

- loss of shareholders and directors’ protection of personal assets

- restriction of tax strategies

If you are a small business owner reading this blog, I hope it will assist you in defining what your responsibities are and when you should engage a lawyer …. or what questions you may want to ask of your own lawyer.

LOPC is your trusted tax adviser and Calgary Accountants. Do you have any tax issue bothering you? We’d love to help. Book a complimentary call with us on +1 (587) 999-6200 and learn how we can assist you better. Visit our blog or website and learn more: www.lopc-cpa.com.